By Lola Butcher, Undark Magazine.

Ilana Yurkiewicz’s patient was in the emergency room and fading fast. Born with a severe kidney condition, the patient — she calls him Mitch Garter — required a perfectly timed medication regimen, including a high dose of potassium, to keep his electrolytes in balance. He had been hospitalized nearly 100 times before he turned 25, but this was the first time Yurkiewicz, then a senior medical resident, had encountered him.

She knew he needed potassium, but how much? Clicking into his electronic medical record, Yurkiewicz found tens of thousands of words, entered by many different clinicians, but no clear guidance. “Every medical team seemed to create its own plan and gave different doses and rates of infusion, making it easy to overshoot or undershoot,” she writes.

Using the information she cobbled together, Yurkiewicz calculated that the dose Garter needed was “literally the dose of potassium used in lethal injection.” When she entered the order into the electronic chart, it triggered a warning: “Are you sure?”

Two recent books explore a truth that is obvious to nearly everyone who works in health care and surprising to almost everyone else: Through no fault of their own, doctors often don’t know what they are doing and, even when they do, America’s patchwork way of paying for health care may prevent them from doing it.

In “Fragmented: A Doctor’s Quest to Piece Together American Health Care,” Yurkiewicz, an oncologist and internist at Stanford Medicine as well as a journalist, describes a behind-the-scenes reality that the public rarely sees: doctors scrambling to collect patient records — papers sent by fax, compact discs sent through the mail, electronic notes too disorganized to be useful. “Being a doctor means working in a constant state of being partially blindfolded, grasping at bits and pieces of a patient’s narrative to try to craft a coherent whole,” she writes.

Yurkiewicz’s case that fragmentation is the single greatest problem underlying American health care is convincing — that is, until economists Liran Einav and Amy Finkelstein trump that argument with their start-over-from-scratch proposal in “We’ve Got You Covered: Rebooting American Health Care.” Their focus is on the fragmented way that health care is paid for. It is killing people and, the authors maintain, partial fixes like the Affordable Care Act simply reveal that the foundation of the health care system needs to be replaced. “No matter how much we patch it, the old cracks have always reemerged,” they write. “It’s long past time to tear it down and rebuild.”

In 2009, Congress tried to rebuild one part of the health system when it passed the Health Information Technology for Economic and Clinical Health Act. Until then, patient records were almost entirely in paper form, kept in file folders in a doctor’s office or hospital. When patients visited a new doctor or showed up in an emergency room, getting the often-crucial information about their diagnoses, medications, allergies, and so forth was either cumbersome or impossible. The 2009 legislation set aside billions of dollars to help physicians and hospitals adopt electronic health record technology that, in theory, would allow patient records to be easily shared with caregivers anywhere in the country.

In the past 14 years, almost every hospital and physician practice has adopted computerized charts, and skilled nursing facilities are getting on board. While the electronic record systems work well for storage, they do not always collate patient information in a way that makes it easy for clinicians to use. And because hundreds of electronic medical record vendors use different technology, widespread electronic sharing of patient information has not yet happened. In a 2018 survey at Yurkiewicz’s own hospital, 80 percent of resident physicians said it was “somewhat difficult” or “extremely difficult” to get information about patients transferred from another health care facility.

Computerized patient charts are a godsend in many ways, Yurkiewicz writes; the technology can alert doctors to potential errors, such as her order for Garter’s unusually high dose of potassium, and offer suggestions for addressing specific diagnoses. But the lack of organization inside the electronic charts — and the logistical challenges of accessing information — eat up time that doctors usually don’t have.

Yurkiewicz recalls that, during her desperate search through Garter’s record, she was paged five to 10 times an hour because she was responsible for 14 other patients. She laments that some parts of an electronic record are searchable while others are not. Because clinicians document in different ways, information input by one doctor is not where the next physician expects to find it. “The electronic charts have built the haystack, but they haven’t yet evolved to find the needle,” she writes.

In Garter’s case, she stumbled across the needle only when she was preparing to discharge him. While most of the other doctors who had treated Garter had entered their reports in the “notes” tab of the electronic record, his regular nephrologist had written the doses of potassium to give, by what route, and how often — “the magic formula I had been seeking” — in the “problem list” tab. As it turned out, Yurkiewicz’s orders were effective, but she wonders what a medical malpractice lawyer would have said if things had turned out otherwise. “The lawyer could point out the information was all here; the doctor just didn’t follow it,” she writes.

In subsequent chapters, Yurkiewicz uses her first-hand experiences to illustrate the many frustrations that prevent physicians from caring for patients the way they want to. For example, because many people, particularly those without insurance, do not have a regular doctor, clinicians who treat them in the hospital struggle — sometimes successfully, other times not —to find a physician that will care for them after they are discharged.

Some of her material was adapted from articles Yurkiewicz has published elsewhere, including Undark. While she ties them together under the theme of fragmentation, that framing sometimes seems like a stretch. In a lengthy description of her own father’s life-threatening medical crisis, Yurkiewicz makes a convincing case that many complications stemmed from her father being overly sedated while on a ventilator. But she acknowledges that the doctor who wrote the sedation order and the nurse who followed it acted reasonably, so the anecdote does not advance her argument about the perils of fragmentation.

By contrast, her chapter about how America’s insurance problem wreaks havoc for physicians and patients alike nails the fragmentation argument. When Yurkiewicz volunteered at a free clinic on a Saturday morning, she saw an uninsured patient she thought might have prostate cancer. She offered to do the preliminary urine and blood tests and recommended that he come back to the clinic to discuss the results with another doctor. “But what if they were suggestive of prostate cancer?” she writes. “The layers of follow-up needed were daunting — and unavailable.”

The fragmentation caused by our insurance system is so vast and dangerous that it deserves its own book, and Einav and Finkelstein, economists at Stanford University and the Massachusetts Institute of Technology, respectively, stepped up to write it. The authors argue that America’s piecemeal health care coverage — some people insured through their work, others by virtue of their income level, their age, or their medical malady — is so sprawling and flawed that it must be replaced by automatic free basic coverage for everyone.

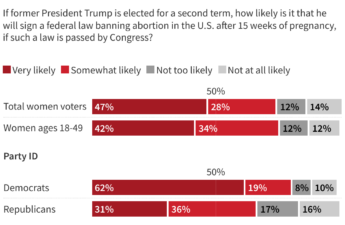

About 90 percent of Americans have health insurance, either private coverage — typically provided through an employer — or one of several government-run programs such as Medicare and Medicaid. That means about 30 million people were uninsured as of 2019. (The authors primarily use pre-2020 data to avoid the distortion caused by the Covid-19 pandemic.) Most insurance reform proposals focus on getting those folks insured, but Einav and Finkelstein write that such an approach has been failing for decades.

For one thing, some uninsured individuals are already eligible for government insurance but are unaware of it or do not know how to apply for and maintain coverage. Beyond this segment of uninsured Americans, “health insurance problems extend to most of the remaining 90 percent of Americans who currently have insurance,” the authors write. “Many live with the constant danger of losing that coverage if they lose their job, give birth, get older, get healthier, get richer, or move.”

Indeed, nearly a quarter of Americans under 65 will be uninsured at some point over a two-year period, often because they changed or lost a job. The problems caused by this disjointed approach to insurance, including exacerbating health conditions and even death, have been documented before, notably in Jonathan Cohn’s 2008 book “Sick: The Untold Story of America’s Health Care Crisis — and the People Who Pay the Price.”

The fresh twist from Einav and Finkelstein is that they show how the health care payment system is not just dangerous but also ridiculous. Describing the folly of tying health insurance to employment, they write: “If a worker becomes too sick to work they can . . . wait for it . . . wait for it . . . that’s right . . . lose their health insurance. Precisely when they really need it to cover their medical bills. Kind of a dumb way to set things up, if you think about it.”

The new idea they offer, and it is an important one, is this: Although America has stubbornly resisted universal health coverage, which is standard in most other high-income countries, the myriad patches being made to extend coverage to particular groups of people ultimately reflects the reality that the country wants everyone to be insured.

In fact, the authors assert that this is the empirical social contract under which the nation operates. “From colonial to modern times,” they write, “the record is clear: Our country has always tried to provide essential medical care to those who are ill and unable to provide for their own care.”

So the government requires hospitals to provide emergency care, regardless of the patient’s ability to pay (although not the care required to recover from illness or injury). And, of course, the government provides insurance programs for some low-income people through Medicaid and everyone 65 and older through Medicare.

Beyond that, the government requires coverage for some diagnoses. The most recent example came during the pandemic, when Congress quickly ruled that the government would cover the medical costs of treating Covid-19 among the uninsured. That decision falls in line with other government programs to cover the medical expenses of patients with tuberculosis, Lou Gehrig’s disease, breast and cervical cancer, end-stage kidney failure, and a few other diagnoses.

All those patches have a common origin story: “A particular problem surfaces, generates public outcry, and prompts (limited) policy action,” Einav and Finkelstein write. The unfairness of that squeaky-wheel-gets-the-grease approach is highlighted in their account of an uninsured woman with late-stage breast cancer who qualified for one of the insurance fixes while her mother, who had late-stage lung cancer, did not. The woman “wryly joked that she had won the ‘cancer lottery,’” the authors write. “At least until her cancer went into remission and her coverage then ended.”

That bizarre approach to insurance also leaves people like John Druschitz — another of the book’s many examples — out in the cold. Insured all his life, he canceled his coverage in April 2020 because he was to become eligible for Medicare 23 days later. During that time, he spent five days in the hospital with Covid-like symptoms, but his test came back negative so he wasn’t eligible for Covid-specific coverage. He didn’t know about other programs that might have covered some of his costs and missed the application window. A year after his ordeal, Druschitz faced more than $20,000 in medical bills and a hospital barking at his door.

“Patching the patchwork inevitably leaves gaps at the seams,” the authors conclude, and the only way to fulfill America’s unspoken social contract is to adopt universal health coverage. Their sweeping plan calls for all Americans to receive free basic coverage — emphasis on basic — and the option to buy additional coverage.

Basic coverage, in their view, should cover all primary and preventive care, specialists, outpatient, emergency and hospital care, regardless of a patient’s medical condition. That does not mean seeing the doctor of your choosing at your preferred time and location, and it doesn’t mean a private room. And it does not mean everything gets covered. What about infertility treatment? Physical therapy? Most countries have a formal process for choosing which services make the cut, and the United States will have to have one as well, the authors write.

In addition, to afford free basic coverage for everyone, we will have to create and enforce a budget for how much the country is willing to spend on health care, just as most other countries do. “Remarkably — and absurdly — the U.S. government has never actually had a health-care budget that caps the amount the government can spend on medical care,” the authors write. That explains why, over the past half-century, “U.S. health-care spending as a share of the economy has grown twice as fast as the average in other high-income countries.”

Einav and Finkelstein draw on decades of economics research and examples from other countries to flesh out their plan. The bottom line is that the basic universal coverage they propose would be better for the 30 million Americans currently uninsured; about the same for the 70 million low-income people now covered by Medicaid; and a bit worse — with longer wait times for non-emergency care and no fancy hospital rooms — for the 150 million who currently have private insurance and the 65 million who have Medicare. Even so, as in most other countries, people who could afford to do so would buy supplemental coverage, and nobody would worry about losing coverage, regardless their financial situation.

“‘How can this ever happen politically?’ is surely, by now, echoing from the peanut gallery,” the authors write, acknowledging that universal coverage proposals have been going down in flames for decades. Surprisingly, their answer to this question is the most uplifting part of the book.

For more than a century, prognosticators have been predicting that universal coverage is imminent, and serious attempts to make it happen have been launched by both political parties. Those efforts have all failed, but as the authors recount several near-misses in the U.S. — and the difficult, but ultimately successful, efforts to pass universal coverage in Canada and the U.K. — even the jaded “It’ll never happen here” reader may start to believe that free universal coverage in America will eventually come to pass. “But for a quirk of fate,” they write, “universal health insurance would have been adopted in the U.S. at key junctures.”

Taken together, these two books paint a full picture of the sorry state of American health care — both for patients who need care and the clinicians who want to, but often cannot, provide it. “The story of how we got here is complicated,” Yurkiewicz writes. “It’s a story of misaligned incentives and unintended consequences. But the conclusion is not complicated: our current health care system has failed. The question now is, how do we dig ourselves out?”

This article was originally published on Undark. Read the original article.