BY: ANNA CLAIRE VOLLERS – Stateline

Some illnesses and injuries — say, a broken ankle — can send you to numerous health care providers. You might start at urgent care but end up in the emergency room. Referred to an orthopedist, you might eventually land in an outpatient surgery center.

Four different stops on your road to recovery. But as supersized health care systems gobble up smaller hospitals and clinics, it’s increasingly likely that all those facilities will be owned by the same corporation.

Hospital trade groups say mergers can save failing hospitals, especially rural ones. But research shows that a lack of competition often leads to fewer services at higher costs. In recent years, federal regulators have been taking a harder look at health care consolidation.

Yet some states, notably those in the South, are paving the way for more mergers.

Mississippi passed a law this year that exempts hospital acquisitions from state antitrust laws, while North Carolina considered legislation to do the same for the University of North Carolina’s health system. Louisiana officials approved a $150 million hospital acquisition late last year that has ignited a legal battle with the Federal Trade Commission over whether they allowed a monopoly.

States including South Carolina, Tennessee, Texas and Virginia have certificate of public advantage (COPA) laws that let state agencies determine whether hospitals can merge, circumventing federal antitrust laws. And large hospital systems wield significant political power in many state capitals.

‘A tool in the tool belt’

Nearly half of Mississippi’s rural hospitals are at risk of closing, according to a report from the Center for Healthcare Quality & Payment Reform, a nonprofit policy research center.

Mississippi leaders hope easing restrictions on hospital mergers could be a solution. A new law exempts all hospital acquisitions and mergers from state antitrust laws and classifies community hospitals as government entities, making them immune from antitrust enforcement.

We saw primary care offices get shut down. We’ve seen our specialists leave for out of state. Several of the outlying hospitals saw services cut even though they were told it wouldn’t happen.

– Kerri Wilson, a registered nurse in North Carolina

Mississippi, one of the poorest states in the nation, is also one of the least healthy, with high rates of chronic conditions like heart disease and diabetes. It is one of 10 states that haven’t expanded Medicaid under the Affordable Care Act, and has one of the nation’s highest percentages of people without health insurance.

“Like many states in a similar socioeconomic status, Mississippi has difficulties with patients that are either not insured or underinsured,” said Ryan Kelly, executive director of the nonprofit Mississippi Rural Health Association. Food insecurity and lack of reliable transportation mean rural residents tend to be sicker and more expensive to treat.

That’s part of the reason why so many Mississippi hospitals operate in the red. The largest hospital in the Mississippi Delta region, Greenwood Leflore, is at immediate risk of closure even after hospital leaders shuttered unit after unit — including labor and delivery, and intensive care — in an effort to remain solvent.

A deal for the University of Mississippi Medical Center to purchase Greenwood Leflore fell through last year. Now, with the new law in effect, the hospital’s owners — the city and county — are soliciting new bidders and offering them the option to buy the hospital outright.

Kelly said he expects to see more Mississippi hospitals consolidate over the coming decade. Some have already had conversations around merger possibilities after the new law went into effect, though talks are in early days.

“It’s a tool in the tool belt,” he said of the new law. “I think it could be a saving grace for some of our hospitals that are perennially struggling but still serve with good purpose. They could be part of a larger system that could help offset their costs so they’re able to be a little leaner but still provide services in their community.”

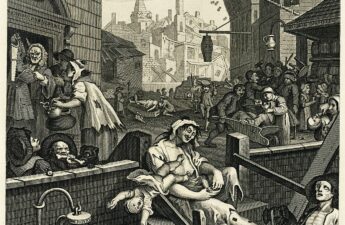

Leaders in some states think consolidation could solve their health care woes, but studies indicate it has a negative impact.

“There’s a large body of research showing that health care consolidation leads to increases in prices without clear evidence it improves quality,” said Zachary Levinson, a project director at KFF, a nonprofit health care policy research organization, who analyzes the business practices of hospitals and other providers and their impact on costs.

When researchers studied how affiliation with a larger health system affected the number of services a rural hospital offered, they found most of the losses in service occurred in hospitals that joined larger systems, according to a 2023 study from the Rural Policy Research Institute at the University of Iowa.

Even when an acquisition by a larger health system helps a struggling hospital keep its doors open, “there can be potential tradeoffs,” Levinson said.

“There’s some concern that, for example, when a larger health system buys up a smaller independent hospital in a different region, that hospital will become less attentive to the specific needs of the community it serves,” and may cut services the community wants because they’re not deemed profitable enough, he said.

Most research suggests hospital consolidation does lead to higher prices, according to a sweeping 2020 report from MedPAC, an independent congressional agency that advises Congress on issues affecting Medicare. The report found that patients with private insurance pay higher prices for care and for insurance in markets that are dominated by one health care system. And when hospitals acquire physician practices, taxpayer and patient costs can double for some services provided in a physician’s office, the report found.

Kelly said he’s not as concerned with consolidation raising costs for Mississippi’s rural residents because so many qualify for subsidized care, but he does think mergers could eliminate some jobs in the health care sector.

“It’s hard to say for sure,” he said. “It is a risk, no question. But I still think it’s a net positive.”

A ‘hospital cartel’

When HCA Healthcare purchased a North Carolina hospital system in 2019, registered nurse Kerri Wilson wasn’t prepared for how much would change — and how quickly — at her hospital in Asheville.

“Once the sale was final in 2019, that’s when it was like the ball dropped and we started seeing staffing cuts,” said Wilson, an Asheville native who has worked in the cardiology stepdown unit at Mission Hospital since 2016.

“We saw our nurse-patient ratios change,” Wilson said. “We saw primary care offices get shut down. We’ve seen our specialists leave for out of state. Several of the outlying hospitals saw services cut even though they were told it wouldn’t happen.”

In the four years since HCA Healthcare bought Mission Health, North Carolinians have hit the nation’s largest health system with multiple antitrust lawsuits, including one that asserts HCA operates an unlawful health care monopoly through Mission Health, and another filed by city and county governments that says HCA’s corporate practices have decimated local health care options and raised costs.

HCA Healthcare did not immediately respond to a request for comment. However, when the second lawsuit was filed, HCA/Mission Health spokesperson Nancy Lindell called it “meritless.”

“Mission Health has been caring for Western North Carolina for more than 130 years and our dedication to providing excellent health care to our community will not waiver [sic] as we vigorously defend against this meritless litigation,” Lindell said in a statement to the Mountain Xpress newspaper. “We are disappointed in this action and we continue to be proud of the heroic work our team does daily.”

Mission’s nurses voted in 2020 to join National Nurses Organizing Committee, an affiliate of National Nurses United, the nation’s largest nursing union, to advocate for higher pay and safer working conditions.

Meanwhile, North Carolina leaders such as Republican State Treasurer Dale Folwell and Democratic Attorney General Josh Stein have spoken out against HCA’s practices. Folwell likened the merger to a “hospital cartel” and both officials filed amicus briefs supporting the plaintiffs in the antitrust lawsuits.

“We have a situation with the cartel-ization of health care in North Carolina where people have to drive miles just to get basic services, and this is unacceptable,” Folwell told Stateline. He said many North Carolinians, particularly those with low incomes, fear seeking medical help because of sky-high medical bills that he said are a result of massive health care systems with little state oversight.

Folwell has publicly criticized the power that the North Carolina Health Care Association, the state’s hospital trade group, wields in the legislature. He calls the group the “leader of the [hospital] cartel.”

Industry groups spent more than $141 million lobbying state officials on health issues in 2021. And out of that $141 million, the hospital and nursing home industry spent the most, accounting for nearly 1 out of every 4 dollars spent on lobbying state lawmakers over health issues.

“This is not a Republican or Democrat issue,” said Folwell, who has lent his support to a bipartisan bill that would limit the power of large hospitals to charge interest rates and rein in medical debt collection tactics. “It’s a moral issue.”

North Carolina Democratic state Sen. Julie Mayfield, who was on the Asheville City Council when HCA acquired Mission Health, sponsored a bill earlier this year that would have curbed hospital consolidations.

In a social media post introducing the bill, Mayfield said she hoped it would “prevent other communities from suffering what we have suffered in the wake of the Mission sale — loss of nursing and other staff, loss of physicians, closure of facilities, and the resulting lower quality of care many people have experienced in Mission hospitals over the last four years.”

Even the Federal Trade Commission jumped in, urging legislators to “reconsider” a bill that would have greenlighted UNC Health’s expansion, saying it could “lead to patient harm in the form of higher health care costs, lower quality, reduced innovation and reduced access to care.” That bill ultimately failed in the state House, as sentiment among some North Carolina leaders had already soured on hospital mergers.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

SUBSCRIBE

In most U.S. markets, a single hospital system now accounts for more than half of hospital inpatient admissions. Federal regulators have been scrutinizing health care mergers more carefully in recent years, said KFF’s Levinson. The FTC has both sued and been sued by health care systems in Louisiana this year, and recently released a draft version of new guidelines on anti-competitive practices.

“People have viewed those guidelines as indicating the FTC and [the U.S. Department of Justice] will be more interested in aggressively challenging anti-competitive practices than in the past,” Levinson said.

Both the Trump and Biden administrations issued executive orders directing federal agencies to focus on promoting competition in health care markets. President Joe Biden’s order noted that “hospital consolidation has left many areas, particularly rural communities, with inadequate or more expensive healthcare options.”

In Mississippi, the hospital mergers law received widespread support from most of the state’s GOP leaders. But the state’s far-right Freedom Caucus came out against it, with Republican state Rep. Dana Criswell, the chair of the caucus, calling it “an attempt at a complete government takeover” of Mississippi’s hospitals.

Criswell said allowing the University of Mississippi Medical Center to buy smaller hospitals “will create a huge government protected monopoly, driving out competition and ultimately putting private hospitals out of business.”

‘Trying something different’

Wilson, the Asheville nurse, said she used to have three or four patients per shift before the merger; now she typically has five. That gives her an average of 10 minutes per patient per hour. It’s not enough time, she said, to give patients their medication, answer questions and perform other tasks that she said nurses often take on because other departments are short-staffed.

Sometimes, she said, those tasks include helping patients go to the bathroom because there aren’t enough nursing assistants or taking out the trash because of a shortage of cleaning staff. Meanwhile, the waiting rooms are overflowing.

Wilson joined the new Mission Hospital nurses union, which was able to negotiate raises for its members. The union continues to protest working conditions, including staff-patient ratios.

But Kelly, of the Mississippi Rural Health Association, said that in his state, mergers are an opportunity for positive change.

“It’s not like health care in Mississippi is at the top of the list for good things,” he said. “I think this is an example of trying something different and seeing if it works.”