by Jacquelyn Jimenez Romero, Washington State Standard

April 9, 2025

Washington hospitals are raising alarm that taxes and insurance payment caps proposed in the state Legislature could jeopardize their finances and undermine patient care.

The House and Senate are both looking at putting new limits on the reimbursement rates that health insurance plans for state workers and public school employees pay. Both chambers’ budget proposals also depend on taxes that could apply to hospitals with larger amounts of revenue.

“There’s going to be less money for patient care,” said Chelene Whiteaker, senior vice president of government affairs at the Washington State Hospital Association.

On the other side of the debate are advocates who contend that hospitals are not paying their fair share in taxes and that care should be more affordable.

“Patients are always the ones who are asked to tighten our belts or skip needed lifesaving care to protect mega hospitals’ bottom lines,” said Sam Hatzenbeler, senior policy associate at the Economic Opportunity Institute. “There is an inherent imbalance that needs to be addressed.”

“Everybody’s being asked to tighten their belts, but the health care industry is not asked ever to tighten theirs,” she added.

But industry officials say hospitals are still recovering from the COVID-19 pandemic and grappling with rising expenses that often outweigh revenue.

According to the hospital association, Washington hospitals lost $1.74 billion in 2023. While the number is high, it was an improvement from the $2.1 billion hospitals lost in 2022.

In 2023, state lawmakers moved to strengthen hospitals’ finances by approving a plan to secure more federal Medicaid dollars.

House Majority Leader Joe Fitzgibbon, D-Seattle, noted that hospitals are one of the largest recipients of state tax dollars through Medicaid, public employee insurance payments and Cascade Care, which is a public health care coverage option available in Washington.

“It’s a tough spot to be in, no question, but the reality is our budget is very squeezed right now and we’re going to have to ask hospitals as well as other beneficiaries of state payments to tighten their belts,” he added.

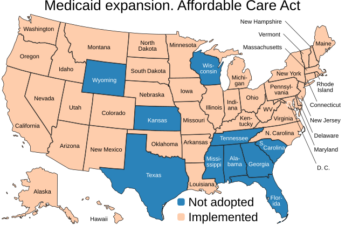

Hospitals are also facing uncertainty at the federal level as Republicans in Congress contemplate cuts to Medicaid.

Eric Lewis, the hospital association’s chief financial officer, said Medicaid cuts combined with the proposed state policies “could send hospitals back into financial distress.”

Both chambers had proposed bills — Senate Bill 5083 and House Bill 1123 — to limit health insurance reimbursements for hospitals under health plans for state and school employees. Senate Bill 5083 is still in play. It passed the Senate in March with only Democratic support and now awaits a floor vote in the House.

Supporters say that in addition to lowering state spending, the bill will also reduce out-of-pocket costs for patients.

But by capping the amount a health plan pays for services, the hospital association estimates $170 million in revenue would be lost.

Oregon has adopted a comparable policy, while states like Colorado, Nevada and Connecticut are looking to pass similar legislation. Hatzenbeler said that in Oregon, the state saved $100 million in the first two years and that out-of-pocket costs fell by 9.5% for patients.

Meanwhile, the House is looking to increase the state’s business and occupation tax, which would affect businesses making over a certain amount of revenue. Some large hospitals would pay the higher tax. Around 20% of hospitals — along with some other entities affiliated with them, like doctors’ offices and long-term care facilities — would pay around $110 million to $130 million more in taxes annually under the House plan, the hospital association estimates.

The Senate is also contemplating a new payroll tax on large employers, which the hospital association says would raise hospitals’ tax bills by about $160 million a year.

Hospitals say if these proposals passed, they would be under pressure to negotiate with private insurers to offset the financial hit. If those negotiations aren’t successful, then hospitals would be left looking at options like service cuts or layoffs, or allowing wait times to rise for patients.

“We do understand that the Legislature is dealing with a budget deficit, but this level of damage that these proposals are doing is intense,” Whiteaker said.

Larry Delaney, president of the Washington Education Association, the largest union for public school educators in the state, said that with many people already struggling to afford health care, hospitals should lower executive pay before asking patients to shoulder more of the burden.

“Corporate executives cry wolf every time they’re asked to do their part,” Delaney said. “[Senate Bill 5083] gives many Washington workers hope for more affordable care.”

Washington State Standard is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. Washington State Standard maintains editorial independence. Contact Editor Bill Lucia for questions: info@washingtonstatestandard.com.